We’ve known for a while that a gender imbalance exists in the data centre world. But when only 8% of respondents to our 2025 Data Centre Salary Survey were female – roughly one in twelve – it brought that reality into sharper focus.

Interestingly, when we asked our LinkedIn community how they felt about this figure, more than half said they expected it to be even lower. That says a lot, not just about perception, but about what we’ve come to accept as ‘normal’.

So we decided to dig deeper.

We’ve pulled out five key takeaways about women working in the industry today, and we’ve spoken to experts on what needs to happen next if we want to see real change.

1. The gender pay gap is very real

Let’s get straight to it: women are earning less than men, across almost every job title, region, and level of seniority.

Here’s what the data shows:

- At junior level, the gap is around 5%

- At mid-level and senior, it jumps to 17%

- At C-suite level, it’s 15%

To put that into real numbers:

A female Construction Manager earns, on average, £25k less than a male one. For Project Managers, the difference is around £8.5k.

This isn’t about experience either. Among professionals with 10–15 years in the industry, men are still more likely to hold senior or exec-level roles, and earn more in them.

Women are also slightly less likely to receive a bonus or pay rise:

- Pay rise: 66.3% of women vs. 68.3% of men

- Bonus: 77.0% of women vs. 79.3% of men

So while the pay gap isn’t always huge, it’s consistent – and that consistency compounds over time

2. A clear seniority ceiling

The data indicates that there’s a career ceiling that many women just aren’t getting past.

- Only 3% of female respondents are in C-suite roles (vs. 3.6% of men)

- Only 40.6% are in senior roles (vs. 59.8% of men)

- Meanwhile, 47.5% are in mid-level roles, and 8.9% in junior ones – despite having an average of 8.1 years of experience.

So yes, women are progressing. But they’re not progressing as fast, or as far.

3. Job roles still reflect traditional divides

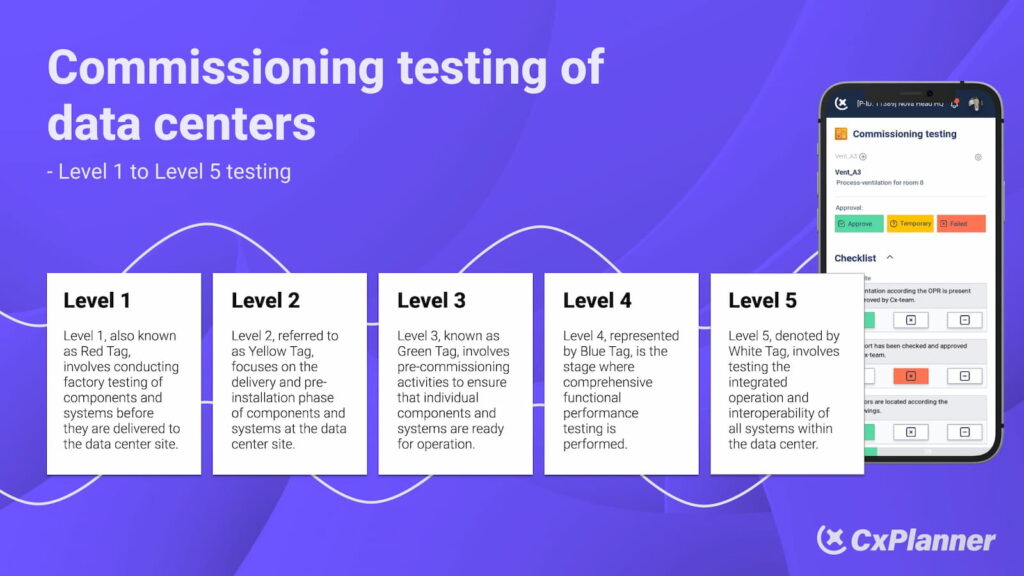

We looked at ten job types across data centre construction and operations. Some areas – like operations and commissioning – are still overwhelmingly male.

Project management stood out as the most balanced category, with women making up between 15–20% of the workforce in those roles. It’s progress – but there’s still a long way to go.

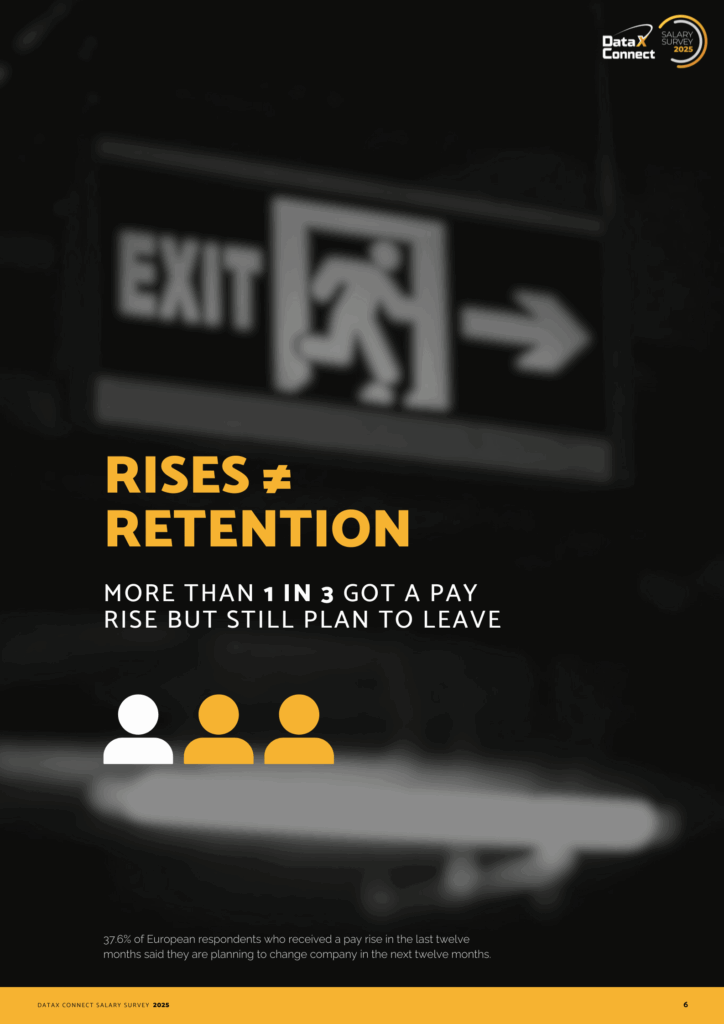

4. More women are preparing to move

More women than men are planning to move in the next 12 months. That could signal ambition (or frustration).

We’ve heard from plenty of women who say asking for a pay rise or promotion just isn’t something that feels encouraged. In some cases, moving on is the only real route to progression – especially when it comes with a bigger salary.

5. Women are asking for different things

Everyone wants better benefits. But men and women tend to value different things. Both groups gave fairly average satisfaction scores for their current packages:

- Base pay: 3.6/5

- Bonus: 3.1/5

- Benefits: 3.4/5

But when it comes to what they want more of, women lean slightly more towards wellbeing and flexibility, and men are more likely to ask for financial-based benefits.

So… what now?

We asked Lizzy McDowell, who leads the Critical Careers campaign, what she thought the industry could be doing better. She said that “the data clearly shows that women in the data centre sector are consistently paid less than men, with gaps in salary, bonuses and progression that grow wider at senior levels.

These are uncomfortable truths, but they’re not unique to our industry. What’s different here is the opportunity to change. Compared to other sectors I’ve worked in, the data centre industry feels more supportive and more open to having these conversations. From speaking to women through the Critical Careers campaign, it’s clear these issues are widespread. Many women can find salary discussions difficult to navigate. But changing this won’t happen by accident!

Companies need to be proactive. That means being transparent with salary bands, evaluating progression criteria fairly, and creating spaces where women don’t have to fight for what they’ve already earned. If we get this right, we won’t just attract more women into the industry – we’ll keep them here.”

The bottom line

This industry is full of opportunity. It’s high-growth, it’s high-reward, and there’s a huge need for talent.

But we can’t ignore the gaps. And we can’t assume they’ll fix themselves.

We need to create working cultures that allow everyone to thrive. That means being more aware of how progression happens, how pay is set, and how support is offered. Because when we get that right, the benefits aren’t just for women – they’re for everyone.

60 responses to “Is the Data Centre Industry Doing Enough for Women?”

-

I must say this article is extremely well written, insightful, and packed with valuable knowledge that shows the author’s deep expertise on the subject, and I truly appreciate the time and effort that has gone into creating such high-quality content because it is not only helpful but also inspiring for readers like me who are always looking for trustworthy resources online. Keep up the good work and write more. i am a follower.

-

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

-

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

-

This was beautiful Admin. Thank you for your reflections.

-

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

-

I just like the helpful information you provide in your articles

-

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

-

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

-

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

-

I must say this article is extremely well written, insightful, and packed with valuable knowledge that shows the author’s deep expertise on the subject, and I truly appreciate the time and effort that has gone into creating such high-quality content because it is not only helpful but also inspiring for readers like me who are always looking for trustworthy resources online. Keep up the good work and write more. i am a follower. https://webdesignfreelancerfrankfurt.de/

-

The live dealer blackjack at fortunica casino login feels so real.

The dealers are professional and friendly. -

Ставлю на киберспорт, и Melbet предлагает просто огромный выбор турниров.

Очень круто!https://flexedgeglobal.in/melbet-kazino-skachat-polnyj-obzor/

-

Поддержка работает без выходных.

Это очень важно для игроковhttps://www.agrifresh.co.za/melbet-skachat-prilozhenie-na-ios/

-

Стриминговые зарубежные сериалы так

затягивают, не могу оторваться! -

Смотреть сериалы с русской озвучкой онлайн

— мой способ отключиться от рутины! -

This is a great article, i am simply a fun, keep up the good work, just finish reading from https://websiteerstellenlassenbamberg.de// and their work is fantastic. i will be checking your content again if you make next update or post. Thank you

-

Great article! I really appreciate the clear insights you shared – it shows true expertise. As someone working in this field, I see the importance of strong web presence every day. That’s exactly what I do at https://webdesignfreelancerhamburg.de/ where I help businesses in Hamburg with modern, conversion-focused web design. Thanks for the valuable content!

-

Search your potential customers by sector, technology, duties and 15+ advanced

filters.Feel free to surf to my web site – high-quality backlinks

-

Aceites esenciales antiinflamatorios en HondroLife

son un regalo para mis articulaciones. -

Best Italian video production services production company in Italy!

Reliable and Efficient, captured masterpiece in one take. on time. -

Keep up the great piece of work, I read few posts on this website and I think that your blog is rattling interesting and contains lots of superb information.

-

Simply desire to say your article is as amazing. The clearness for your publish is just spectacular and that i can suppose you’re knowledgeable in this subject. Fine along with your permission let me to seize your RSS feed to keep updated with forthcoming post. Thanks one million and please keep up the enjoyable work.

-

Кэшбэк начисляют в понедельник,

всегда вовремя -

Играю с Турции, VPN не нужен, сайт

открывается напрямую -

Кэшбэк до 20% для VIP, уже на 12%

https://ativaadministradora.com.br/2025/10/20/melbet-promokody-2025-bonusy-sovety/

-

Слоты с RTP 98%, реально отдаёт

https://orientbaselogistics.org/stavki-na-sport-melbet-2025-obzor/

Leave a Reply